39 zero coupon bonds definition

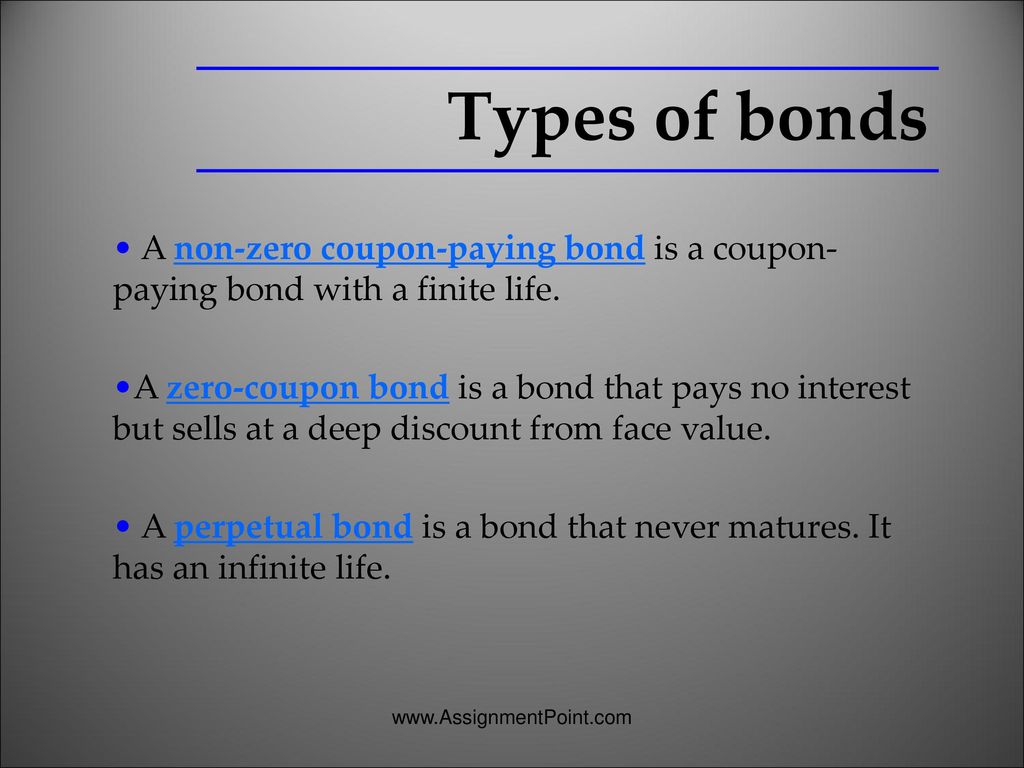

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww What is Zero Coupon Bond? Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure. Zero-Coupon Bonds Definition | Law Insider Define Zero-Coupon Bonds. means the senior unsecured convertible zero-coupon bonds due 2021 issued by the Borrower on May 7, 2001.

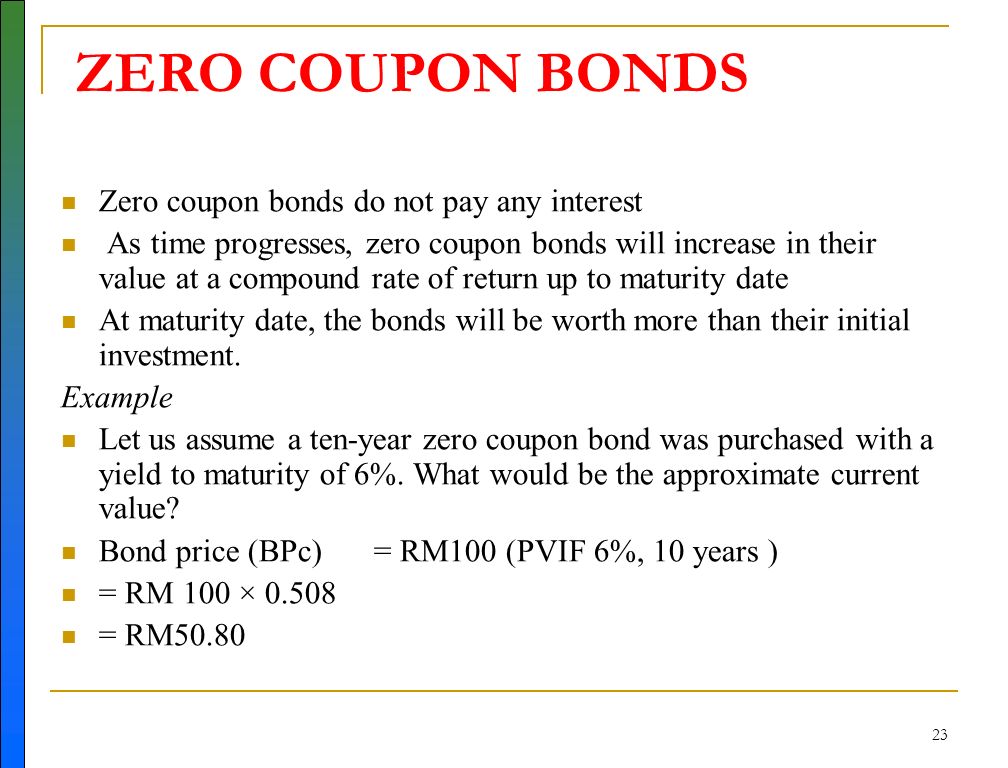

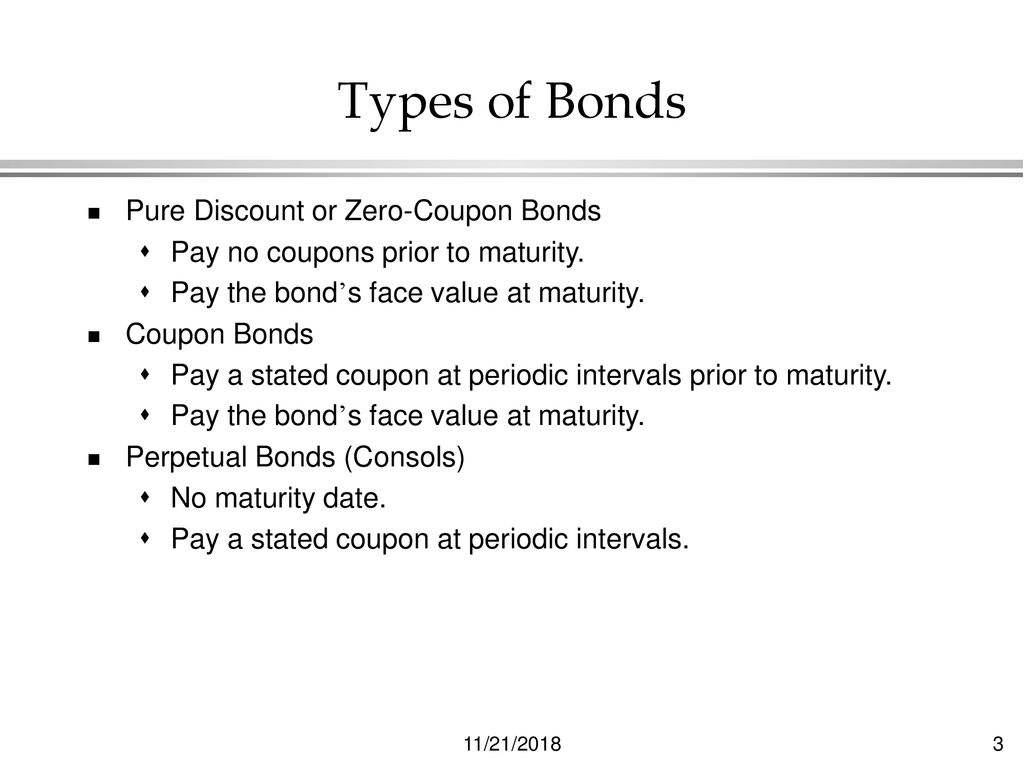

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Zero coupon bonds definition

What is a Zero-Coupon Bond? Definition and Meaning A zero-coupon bond, also known as a discount bond, is a type of bond that is purchased at a lower price than its face value. The face value is repaid when the bond reaches maturity. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy. Zero-Coupon Bonds - Accounting Hub A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero coupon bonds definition. Zero Coupon Bonds Explained (With Examples) - Fervent Zero Coupon Bonds, aka "Deep Discount Bonds", or "ZCBs" are bonds (a type of debt instrument) that don't pay any coupons (aka interest). In other words, there is no coupon payment (aka interest payment). They pay a zero coupon. Hence the name, zero coupon bond. The only thing they do pay is the Par (aka "face value") when the bond matures. Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment. Fidelity.com Help - Glossary: Z Z. Zero Coupon Bond. A bond where no periodic interest payments are made. A bond where no periodic interest payments are made. The investor purchases the bond at a discounted price and receives one payment at maturity that usually includes interest. They tend to have higher price volatility than coupon bonds. Back. Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Most bonds make regular interest or "coupon" payments—but not zero-coupon bonds. Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. xplaind.com › 945823Coupon Payment | Definition, Formula, Calculator & Example Apr 27, 2019 · For example, a bond may have coupon rate equal to LIBOR + 3%. Since LIBOR is variable, the coupon rate and coupon payments are variable too for this bond. In deferred coupon bonds, initial coupon payments are deferred for a certain period while in accelerated coupon bonds, the coupon rate is high initially but decreases over the life of the bond. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero-Coupon Bonds - Accounting Hub A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning. What is a Zero-Coupon Bond? Definition and Meaning A zero-coupon bond, also known as a discount bond, is a type of bond that is purchased at a lower price than its face value. The face value is repaid when the bond reaches maturity. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Post a Comment for "39 zero coupon bonds definition"