44 coupon value of a bond

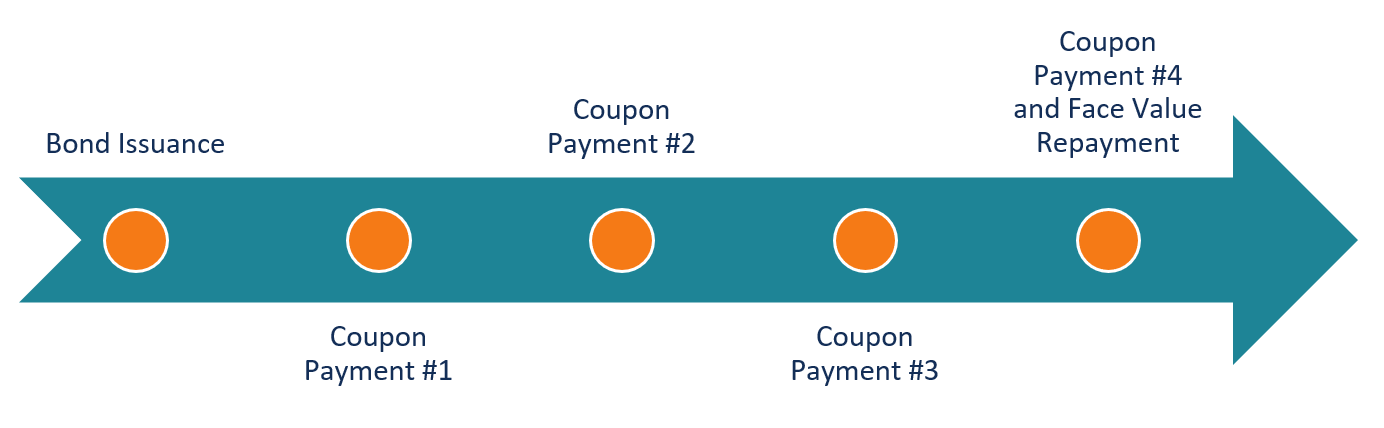

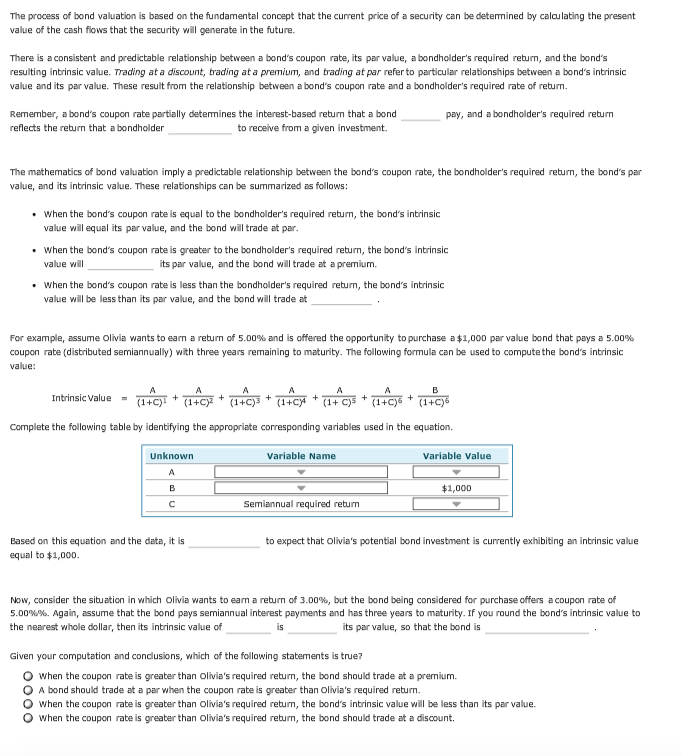

› terms › cCoupon Bond - Investopedia Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

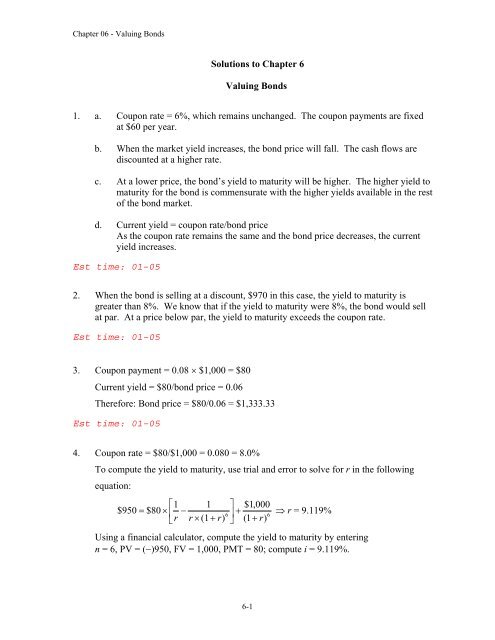

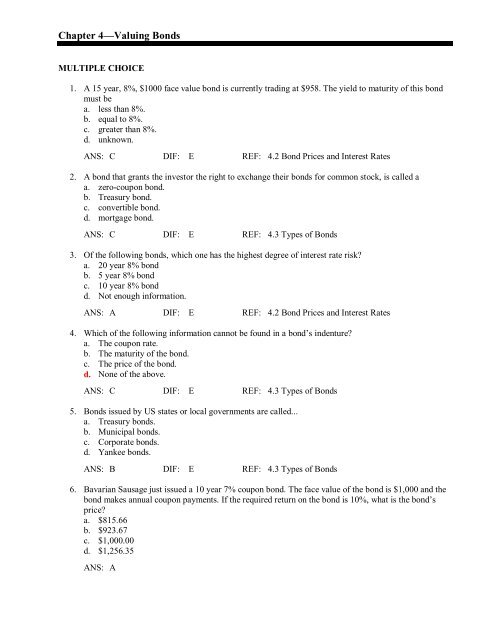

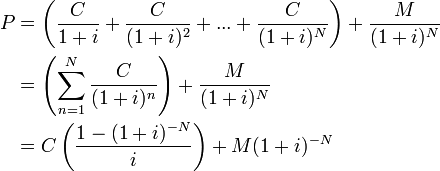

› coupon-bond-formulaHow to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security).

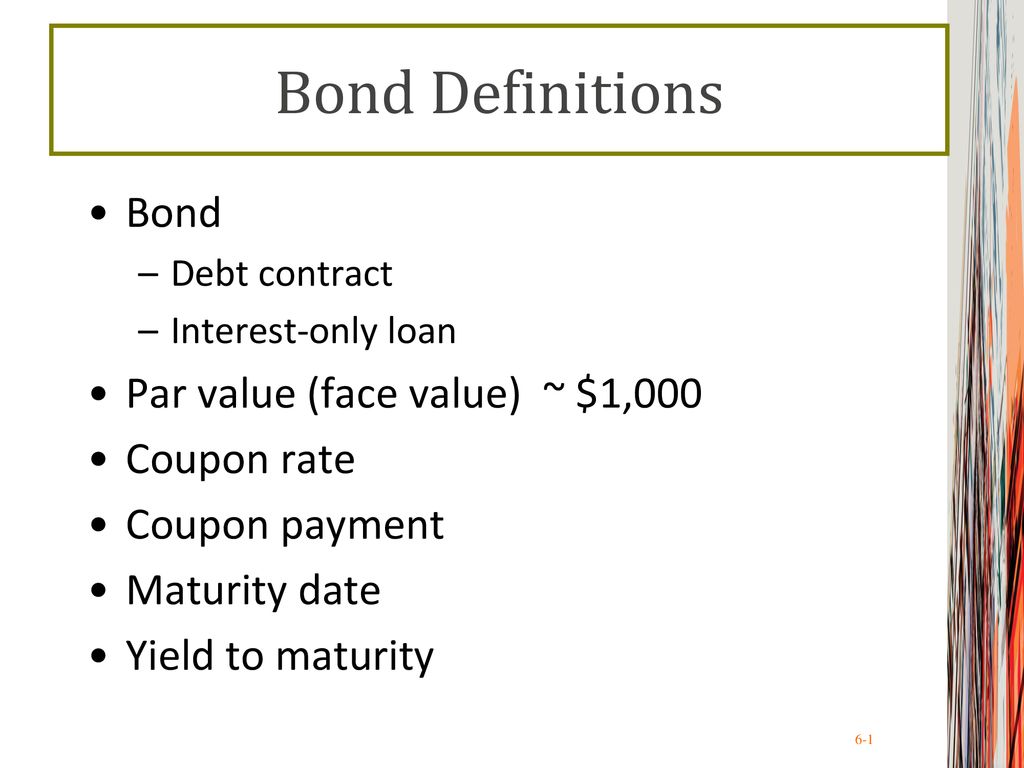

Coupon value of a bond

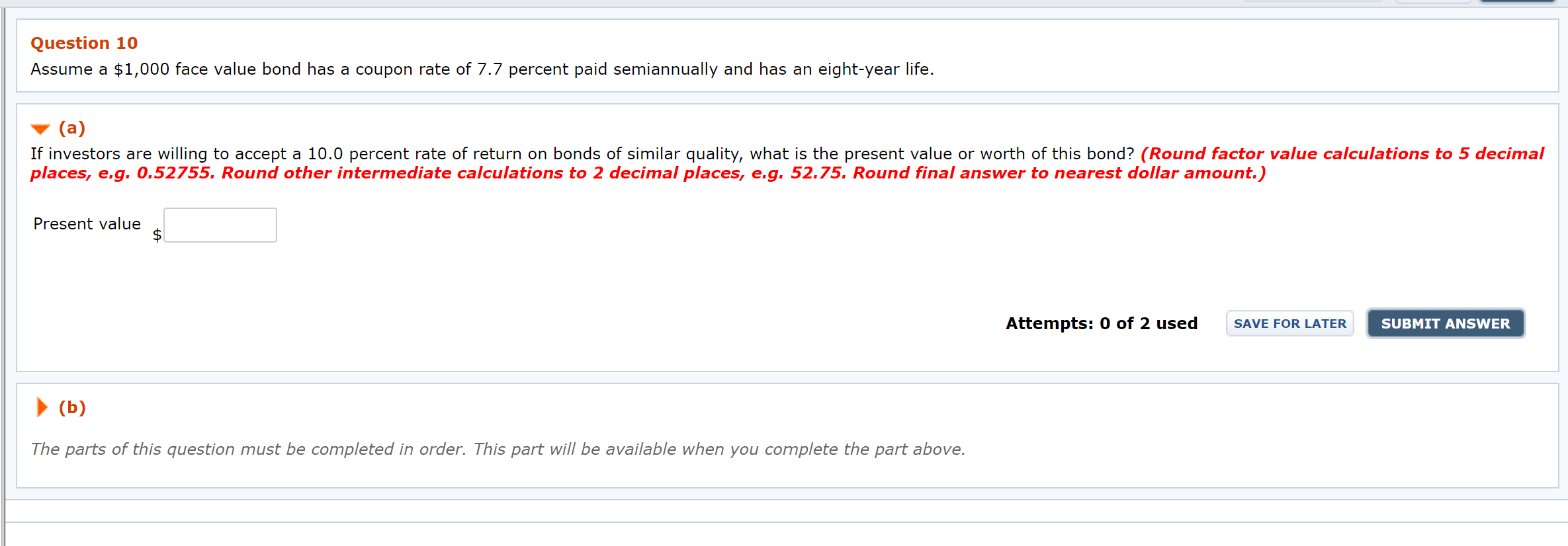

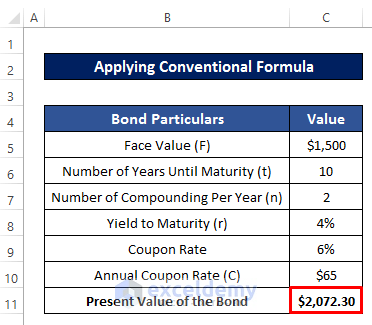

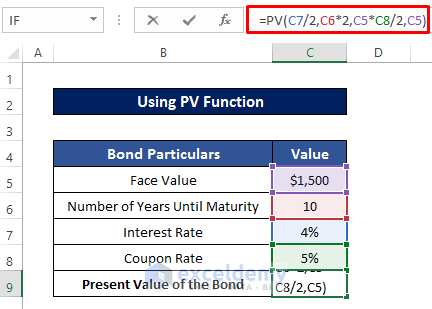

Bond Present Value Calculator Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. If the market rate is greater ... Calculation of the Value of Bonds (With Formula) - Your Article … Par value of bond: Rs. 1,000 . Coupon rate Maturity: 10% p.a. Maturity: 5 years . Current Market Price: Rs. 600 . Reinvestment Rate of future cash flows: 12% . The future value of the bond is calculated in the following way: Future Value of Bond: Total future value 157.4 + 140.5 + 125.4 + 112.0 + 100 + 1000 = 1635.3 Coupon Rate Definition - Investopedia

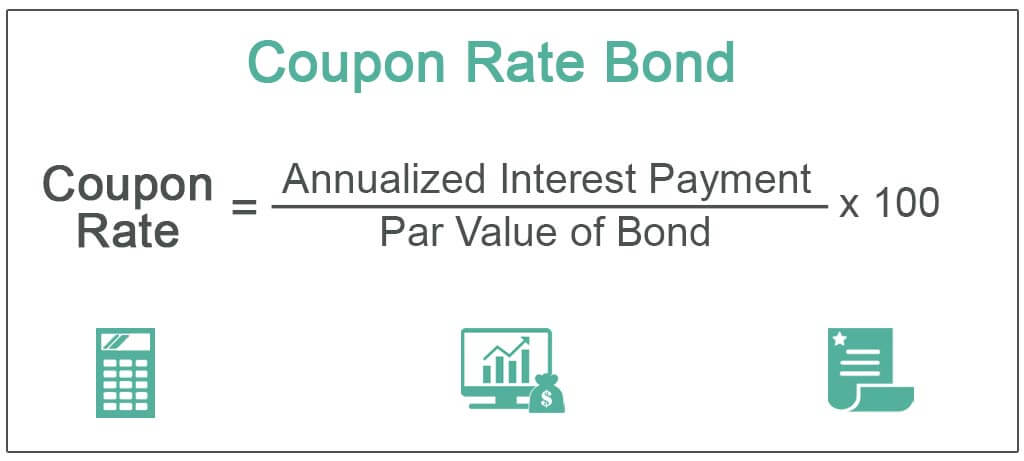

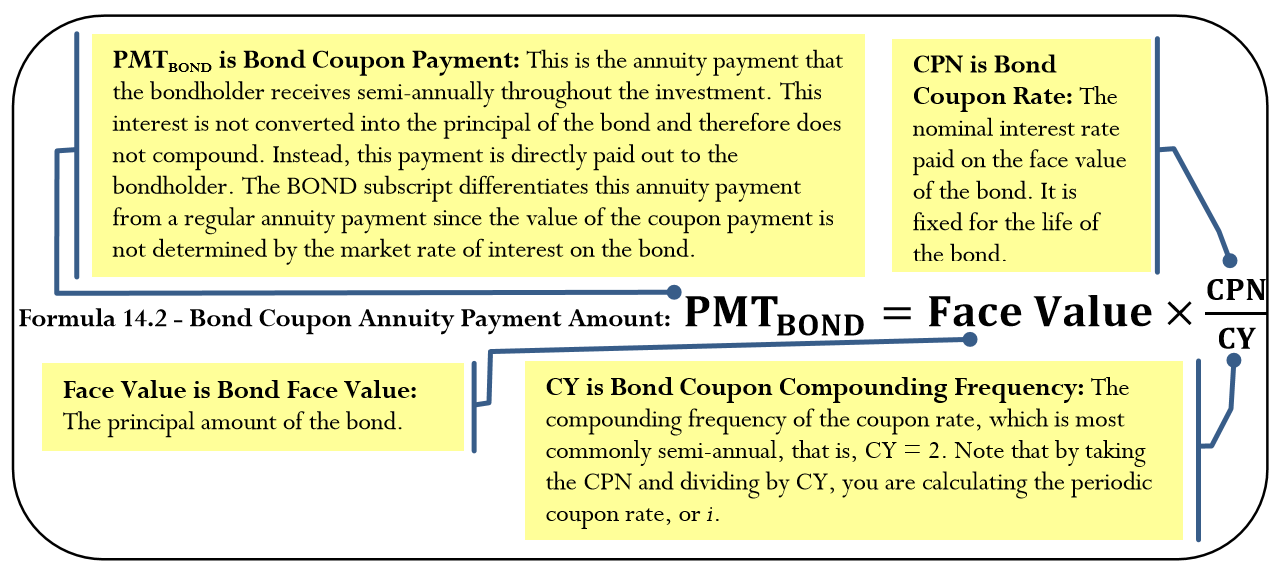

Coupon value of a bond. › bond-valueBond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par ... smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or “par value”) of the bond. For example: ABC Corp. releases a bond worth $1,000 at issue. Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then ... › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.

Coupon Rate Definition - Investopedia Calculation of the Value of Bonds (With Formula) - Your Article … Par value of bond: Rs. 1,000 . Coupon rate Maturity: 10% p.a. Maturity: 5 years . Current Market Price: Rs. 600 . Reinvestment Rate of future cash flows: 12% . The future value of the bond is calculated in the following way: Future Value of Bond: Total future value 157.4 + 140.5 + 125.4 + 112.0 + 100 + 1000 = 1635.3 Bond Present Value Calculator Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. If the market rate is greater ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 coupon value of a bond"