41 zero coupon bond value

Calculate Zero Coupon Bond Value - calculatoratoz.com How to calculate Zero Coupon Bond Value using this online calculator? To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/(1+4/100)^10. Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Example of a Zero-Coupon Bonds Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53.

How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ...

Zero coupon bond value

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bonds Explained (With Examples) - Fervent We know that the price of a zero coupon bond is estimated as… Plug in the numbers of the bond Warren B Inc's evaluating and you've got… Solve for that, and you'll find that the price of the bond is approximately equal to £93.46 Now, recall from the question - the bond was trading at $814.39. That means it's overvalued by approximately $84.78 Difficulty level easy zero coupon bond a 40 the value See Page 1. Difficulty level: Easy ZERO COUPON BOND a 40. The value of a 20 year zero-coupon bond when the market required rate of return of 9%(semiannual) is ____. a. $171.93b. $178.43 c. $318.38d. $414.64 e. None of the above. Difficulty level: Easy YIELD TO MATURITYc 41. The bonds issued by Jensen & Son bear a 6% coupon, payable semiannually.

Zero coupon bond value. Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. Zero Coupon Bonds - Financial Edge What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. Calculating yield-to-maturity or expected returns. Zero Coupon Bond | Definition, Formula & Examples 18 Feb 2022 — The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 ... Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ...

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are issued at a minimum face value of $1,000, and the earliest a Treasury zero bond matures is in 10 years. The bond interest income is taxed at the federal level and possibly at the ... How to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) What Is a Zero-Coupon Bond? | The Motley Fool Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able to purchase a bond for $6,139.11, wait 10 years, and redeem it for $10,000.... Zero Coupon Bond Calculator - Nerd Counter Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

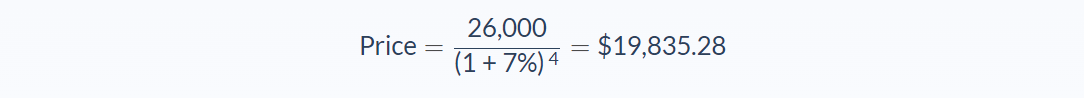

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Zero-Coupon Bond Pricing Example. If an investor wanted to make 5% imputed interest on a zero-coupon bond with a face value of $15,000 that matures in four years, how much would they be willing to ... What are Zero-Coupon Bonds? (Characteristics and Examples) Zero-Coupon Bond – Bondholder Return. The return to the investor of a zero-coupon bond is equal to the difference between the face value of the bond and its purchase price. In exchange for providing the capital in the first place and agreeing not to be paid interest, the purchase price for a zero-coupon is less than its face value. 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. To illustrate, assume that on January 1, Year One, a company offers a $20,000 two-year zero-coupon bond to the public. A single payment of $20,000 ... Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia A zero-coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full-face value. A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide The absence of regular periodic payments is what makes zero-coupon bonds different as compared to other types of bonds. Zero-coupon bonds are commonly issued by governments. In this article, we will have a closer look at the pros and cons of zero-coupon bonds from an investor's point of view: Pros of Zero-Coupon Bonds. There are many zero ...

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Zero Coupon Bond Value Calculator - Find Formula, Example & more Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5 When we solve the equation barely by hand or use the calculator we put up, the product will be Rs.747.26. So, the original price of the share in question is Rs.747.26, which can then be redeemed at a face value of Rs.1000. What is the use of Zero Coupon Bond Value Calculator?

Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

How to Calculate the Price of a Zero Coupon Bond Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00.

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Difficulty level easy zero coupon bond a 40 the value See Page 1. Difficulty level: Easy ZERO COUPON BOND a 40. The value of a 20 year zero-coupon bond when the market required rate of return of 9%(semiannual) is ____. a. $171.93b. $178.43 c. $318.38d. $414.64 e. None of the above. Difficulty level: Easy YIELD TO MATURITYc 41. The bonds issued by Jensen & Son bear a 6% coupon, payable semiannually.

Zero Coupon Bonds Explained (With Examples) - Fervent We know that the price of a zero coupon bond is estimated as… Plug in the numbers of the bond Warren B Inc's evaluating and you've got… Solve for that, and you'll find that the price of the bond is approximately equal to £93.46 Now, recall from the question - the bond was trading at $814.39. That means it's overvalued by approximately $84.78

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

:max_bytes(150000):strip_icc():gifv()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "41 zero coupon bond value"