39 10 year treasury bond coupon rate

home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present Advantages and Risks of Zero Coupon Treasury Bonds The PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund also gives investors full access to the returns of zero-coupon Treasury bonds. It is possible to buy Treasury zeros the old ...

ycharts.com › indicators › 10_year_treasury_rate10 Year Treasury Rate - YCharts May 06, 2022 · The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury ...

10 year treasury bond coupon rate

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. 10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once... › ask › answersTreasury Bonds: A Good Investment for Retirement? - Investopedia Jan 02, 2022 · Zero-coupon Bond vs. a Regular Bond ... five, seven, and 10 years. The 10-year Treasury note is probably the most monitored of the Treasury securities since it is often used as a benchmark for ...

10 year treasury bond coupon rate. How Is the Interest Rate on a Treasury Bond Determined? As of early June 2020, the rate for a 10-year T-Bond was hovering around .66%. That is a lower typical rate than the five years previous. Rates topped 3% briefly a couple of times during 2018. ... A 10-year U.S. Treasury bond with a face value of $10, 000 ... Question 5: A 6% six-year bond yields 12% and a 10% six-year bond yields 8%. Calculate the six-year spot rate. Assume annual coupon payments. Question 6: Is the yield on high-coupon bonds more likely to be higher than that on low-coupon bonds when the term structure is upward-sloping, or when it is downward sloping? Explain. Market Yield on U.S. Treasury Securities at 10-Year ... View a 10-year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. home.treasury.gov › news › press-releasesTreasury and IRS Announce Aggressive Plan to End Pandemic ... Mar 10, 2022 · Today, Deputy Secretary of the Treasury Wally Adeyemo and IRS Commissioner Charles P. Rettig traveled to the IRS Campus in Philadelphia where they thanked employees for their tireless efforts and outlined an aggressive plan that will end the pandemic backlog this year. “Since the pandemic began, IRS employees have been called on to go above and beyond for the American people, and they have ...

If the coupon interest rate is 4.375% for the first six ... SOMEONE ASKED 👇 If the coupon interest rate is 4.375% for the first six months and changes to a rate equal to the 10-year treasury bond rate plus HERE THE ANSWERS 👇 The board of directors of Capstone Inc. declared a $0.70 per share cash dividend on its $1 par common stock. On the date... Treasury Return Calculator, With Coupon Reinvestment The 10-Year Treasury Return Calculator (With Inflation Adjustment and Coupon Payment Reinvestment) One issue you run into a lot when you are discussing optimal savings strategies is the inability to produce a fair comparison (or, at least, not pay someone for one) - especially when it comes to bonds and treasuries. In the case of the 10-Year Treasury, investors will eyeball a chart of historic ... Individual - TIPS: Rates & Terms - TreasuryDirect Cumulative interest payments for 10 years = $447.43. Terms and Price. TIPS are issued in terms of 5, 10, and 30 years, and are offered in multiples of $100. The price and interest rate of a TIPS are determined at auction. The price may be greater than, less than, or equal to the TIPS' par amount. (See rates in recent auctions.) Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data. View the ...

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News ... Yield Open 2.911% Yield Day High 2.911% Yield Day Low 2.862% Yield Prev Close 2.913% Price 99.9688 Price Change +0.2969 Price Change % +0.3008% Price Prev Close 99.6758 Price Day High 100.1094... in.investing.com › rates-bonds › uUnited States 10-Year Bond Yield - Investing.com India The U.S. 10-Year Bond is a debt obligation note by The United States Treasury, that has the eventual maturity of 10 years. The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity, and should be monitored closely as an indicator of the government debt situation. Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .) United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . ... Muni Bonds 10 Year Yield . 2.88% +2 +42

Thursday’s 30-year TIPS auction is likely to get lowest coupon rate in history | Treasury ...

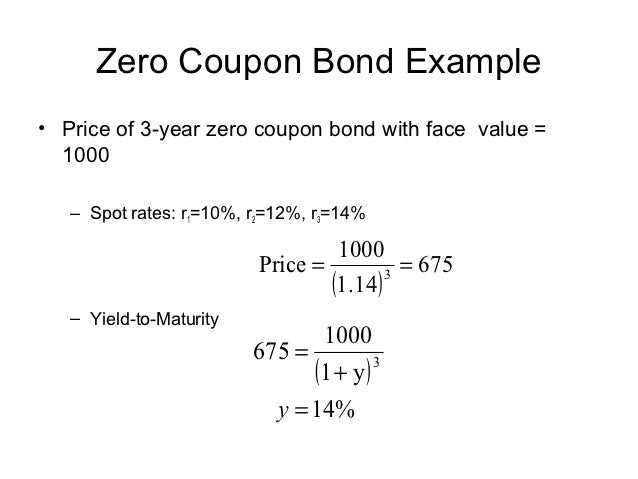

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-05-06 about 10-year, bonds, yield, interest rate, interest, rate, and USA.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

› market-data › quotesTMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today’s stock price from WSJ.

10-Year Treasury Note and How It Works - The Balance 0.06% on the one-month Treasury bill 0.06% on the three-month bill 0.73% on the two-year Treasury note 1.52% on the 10-year note 1.93% on the 30-year Treasury bond 12 Frequently Asked Questions (FAQs) How can I buy a 10-year Treasury note? You can buy Treasury notes on the TreasuryDirect website in $100 increments.

ycharts.com › indicators › us_10year_government_bondUS 10-Year Government Bond Interest Rate - YCharts Jan 31, 2022 · US 10-Year Government Bond Interest Rate is at 2.75%, compared to 2.13% last month and 1.62% last year. This is lower than the long term average of 5.92%.

10 Year Treasury Rate - 54 Year Historical Chart - Macrotrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of May 09, 2022 is 3.05%. Show Recessions Download Historical Data Export Image

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

› ask › answersTreasury Bonds: A Good Investment for Retirement? - Investopedia Jan 02, 2022 · Zero-coupon Bond vs. a Regular Bond ... five, seven, and 10 years. The 10-year Treasury note is probably the most monitored of the Treasury securities since it is often used as a benchmark for ...

Post a Comment for "39 10 year treasury bond coupon rate"